Table of Contents3 Simple Techniques For What Is Bond In Finance With ExampleGetting The What Type Of Bond Offering To Finance Capital Expenditures To WorkGetting The What Is A Finance Bond To WorkThe 15-Second Trick For What Is A Bond Personal FinanceFascination About How Do I Calculate The Yield To Call Of A Bond Using Business Finance OnlineUnknown Facts About What Is Callable Bond In Finance

When you purchase a house, a bank creates a contracta home loan in this casewherein the bank lends you money and you accept pay the bank back, with interest, at some time in the future. Well, with a bond, you resemble the bank, the federal government or company is like the home purchaser and the bond is like the home loan agreement.

Let's have a look at the following attributes of a bond: Stated value is the quantity the bond will deserve at maturity and the amount the bond provider utilizes when computing interest payments. Voucher rate is the rate of interest the bond provider will pay on the face value of the bond.

Maturity date is the date on which the bond will mature and the bond provider will pay the bond holder the stated value of the bond. Issue price is the price at which the bond issuer initially offers the bonds. Lots of financiers wrongly think that once you buy a buy a bond you have to hold onto it until it develops.

You can buy and offer bonds on the free market much like you purchase and offer stocks. In truth, the bond market is much bigger than the stock market. Here are a few terms you must recognize with though when buying and selling bonds: Market value is the cost at which the bond trades on the secondary market.

Offering at a discount rate is the term used to describe a bond with a market value that is lower than its stated value. Image courtesy Horia Varland.

What Precisely Are Bonds and How Do They Work? By Maire Loughran Bonds are long-term loaning contracts in between a debtor and a loan provider. http://johnnykqkb128.theburnward.com/which-of-the-following-would-a-finance-manager-be-concerned-with-fundamentals-explained For example, when a town (such as a city, county, town, or village) needs to build brand-new roadways or a healthcare facility, it releases bonds to finance the task.

The Best Strategy To Use For How To Calculate Nominal Rate On Treasury Bond Intro To Finance

The asking price of bonds, like openly traded stock, is normally set by what the marketplace will bear. The company of the bond sets the rate of interest, which is referred to as the specified, coupon, face, agreement, or nominal rate. All 5 terms indicate the exact same thing the rate of interest given in the bond indenture.

It explains the key terms of the bond issuance, such as maturity date and rate of interest. what is bond indenture in finance. Individuals who buy a bond receive interest payments during the bond's term (or for as long as they hold the bond) at the bond's stated rate of interest. When the bond matures (the regard to the bond expires), the business pays back the bondholder the bond's stated value.

Because this is a chapter on long-term liabilities, it takes a look at this deal from the source of financing viewpoint. Maire Loughran is a certified public accounting professional timeshare cancellation services who has prepared compilation, review, and audit reports for fifteen years. A member of the American Institute of Licensed Public Accountants, she is a full adjunct teacher who teaches graduate and undergraduate auditing and accounting classes.

Stock prices generally increase faster than bond costs, however they're also generally riskier. Bonds, which are loans to governments and companies that release them, are often called great financial investments for older investors who require to rely on steady interest income. Some bonds are riskier than others, and usually pay greater interest as an outcome, so it's great to make sure you understand the specific securities you purchase.

Bonds are perfect investments for retirees who depend upon the interest income for their living expenses and who can not afford to lose any of their savings. Bond costs in some cases benefit from safe-haven purchasing, which takes place when financiers move funds from unstable stock markets to the relative safety of bonds. Governments and companies problem bonds to raise funds from investors.

Credit-rating companies rate bonds based on credit reliability. Low-rated bonds should pay higher interest rates to compensate investors for taking on the greater danger. Corporate bonds are generally riskier than government bonds. U.S. Treasury bonds are thought about safe investments. You can buy bonds straight through your broker or indirectly through bond shared funds.

Getting The What Is A Gt Bond (Finance) To Work

Treasury bonds directly from the department's TreasuryDirect site. The drawbacks of bonds include increasing interest rates, market volatility and credit threat. Bond rates increase when rates fall and fall when rates increase. Your bond portfolio might suffer market value losses in an increasing rate environment. Bond market volatility could impact the rates of private bonds, despite the companies' underlying principles.

Some bonds have call arrangements, which give providers the right to purchase them back before maturity. Issuers are most likely to exercise their early-redemption rights when rates of interest are falling, so you then might need to reinvest the principal at lower rates. Local bonds are issued by states and local entities to finance construction jobs and provide services.

Treasuries, reasonably low danger, and certain tax advantages. Community bonds are exempt from federal income tax and from state and local taxes if you are a resident of the releasing state. what is bond valuation in finance. However unlike Treasuries, these bonds are not safe. In durations of economic crisis, some local federal governments have actually defaulted on their financial obligation responsibilities due to the fact that of plunging tax revenues.

Since 1926, huge company stocks have given financiers a typical yearly return of 10%, while government bonds have balanced in between 5% and 6%. Younger financiers may choose stocks due to the fact that of the opportunity for larger gains in time, while financiers nearing retirement might prefer bonds since they have an interest in getting that routine, trustworthy interest earnings with less threat.

older investors counting on their investments for retirement do not necessarily have the luxury of waiting out the retirement prior to they need those funds, leading some consultants to motivate investors to buy more bonds before they plan to retire. The company can then call back all the bonds at the face value and reissue brand-new bonds with a 10% voucher rate. A lets the bondholders offer back the bond to the business before maturity. Investors that are stressed over the worth of their bonds falling or interest rates rising could then get their primary amount back.

The shareholder will pay the face worth of the bond. The bond will then be repaid at maturity with month-to-month, semi-annual or annual interest payments. A bond's price will alter daily a shareholder does not have to keep their bond until maturity, the bonds can be sold on the free market.

The Definitive Guide for What Is A Bond Finance Rt511

Way of considering a bond's price: a bond's rate will differ inversely to the rate of interest. When rates of interest reduce the bond costs will rise to have an equalizing impact on the rate of interest of the bond. a 10% discount coupon rate, $1000 bond is provided, and the rate decreases to $800.

\ dfrac \$ 100 \$ 800 = 12.5 \% If the cost of the bond increases to $1200 the yield will decrease to 8.33%: \ dfrac \$ 100 \$ 1200 = 8.33 \% is the overall return anticipated on a bond that is held up until completion of its life time. The yield-to-maturity is a complicated computation that is calculated by utilizing a computer system.

The period can be computed by figuring out the cost sensitivity to the interest rate modifications of a bond. Bonds with long maturities and low discount coupon rates have a great level of sensitivity to interest rate modifications. Bond financing has three benefits: Bonds do not impact the ownership of a business where equity funding does.

Interest expenses on a bond are tax-deductible significance although you are incurring interest expenditures in financing the bonds you can subtract the money from tax - why invest in a bond yahoo finance. Equity financing doesn't provide any tax benefits. Financial utilize when financing a bond and the bond makes you return on equity it is monetary leverage.

A bond is released with a stated value of $1000 and a voucher rate of $8. The shareholder will get $80 interest each year if absolutely nothing alters the bond will remain at its face value. The rates of interest starts to reduce, and the business issues a comparable bond with a face value of $1000 and a coupon rate of $5.

The financiers would desire the greater interest rate bonds, they will need to pay extra to convince an existing bond owner to sell their bonds. Brand-new miami timeshare cancellation investors will pay a quantity above the stated value to acquire the preliminary bonds, raising the rate of the bond and hence reducing the yield of the bondIf the rate of interest rises from 8% to 10% then 8% coupons are no longer attractive to purchasers.

Little Known Facts About What Type Of Bond Offering To Finance Capital Expenditures.

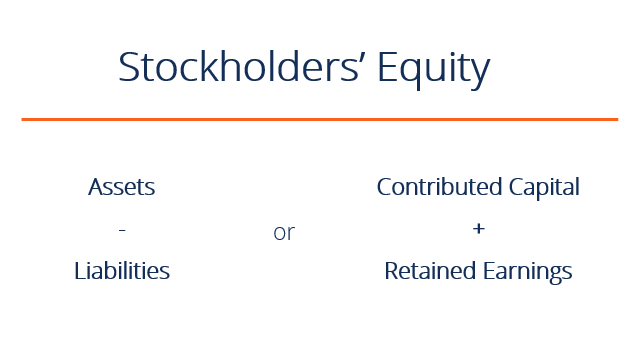

A bond can be specified as set income security that represents a loan by a financier to a customer. There are 4 categories of bonds sold in the markets: Most bonds share some fundamental characteristics including: The marketplace rate of a bond depends on various elements: The credit quality of the issuerVarieties of bondsWay of thinking about a bond's cost: Inverse to Interest RatesBond funding has three benefits: Bonds do not impact the ownership of a companyInterest expenses on a bond are tax-deductibleFinancial take advantage of.

In their simplest kind, bonds are debt responsibilities. A business or government can release bonds in order to raise capital for a specific endeavor. The business has for that reason borrowed money and pays a predetermined interest amount over time as payment. Those who purchase the bonds are understood as 'lending institutions', and the bond or loan note is their IOU.

The yield of any bond is the amount of interest that shareholders (lenders) will receive from the provider. This may be paid quarterly, semi-annually or every year. In uncommon cases, bonds are provided with no deal of interest (zero-coupon bonds) but are sold initially at an affordable rate, with the concept being the lender makes their money at maturity.

The timings differ for residential or commercial property, business and governmental bonds and variety from a few months to 100 years. 'Issuer' is the name offered to the business providing the bond and their stability is obviously the basic element in developing the threat of your investment. Governmental bonds are obviously really low risk due to their nature, while a bond released by a business with no proven track record might be risky.

A business requiring capital issues bonds, consenting to pay them back at a certain date. Fixed interest payments are concurred up until the bond matures when the whole quantity, the principal, is paid back. The principal plus the overall interest paid is referred to as the yield, which is the total roi.

Government bonds, understood in the UK as 'gilt-edged securities' are typically offered at auction to banks who then resell them in the markets. What we provide here at Company Professional are property bonds and loan notes which are a high yield asset-backed investment favoured by both individual and corporate financiers.

All about How To Create Bond Portfolio Yahoo Finance

There are 2 ways of generating income on bonds, the first of which is to simply collect the interest payments till the bond grows. The 2nd way is to offer the bond for more than you spent for it, before the point of maturity. By offering the bond through a broker it's possible to make a capital gain depending on what has taken place to the credit quality of the issuer.